Grocery e-commerce is having its moment following Amazon’s Whole Foods acquisition in June. So, it was about time that Walmart hopped on the bandwagon with some big guns. Jolt upright, the retail behemoth is readying to battle Amazon in the war to attract hungry online shoppers. As Food Dive puts it, “A fundamental shift is happening in the [grocery] industry, and no company is immune to these fluctuating market forces.”

That means global grocers are rethinking their business plans. Even before Amazon’s bombshell purchase of Whole Foods Market, the trend toward e-grocery was apparent. Industry experts predicted online grocery shopping could grow five-fold to $100 billion by 2025. In addition, online grocery shopping was on track to grow from 4% in 2016 of total U.S. food and beverage sales ($20.5 billion) to as much as a 20% share ($100 billion).

Retail giants acquire e-commerce expertise

The promise of such significant online growth led Walmart and Amazon to prioritize strengthening their e-grocery arsenal. Now both companies are battling for younger, urban adults who are most likely to buy groceries online. One study found 66% of adults under the age of 40 now shop online weekly for groceries. In response, Amazon purchased Whole Foods. Meanwhile, Walmart acquired online consumer goods company Jet.com and New York City-based Parcel for same-day grocery delivery.

Even beyond grocery, Walmart acquired several apparel brands – Bonobos, Modcloth and Shoebuy. These deals further prove Walmart is targeting younger, urban shoppers with higher incomes. By attracting these shoppers to its online store, Walmart intends to keep them coming back to buy groceries, too.

Walmart’s e-grocery strategy

Walmart is using its stores to win in e-commerce, including e-grocery. Walmart’s abundance of brick-and-mortar stores is a strategic advantage that Amazon lacks.

Walmart has expanded its buy online pickup in store (BOPIS) service to more physical stores. The service has successfully attracted customers who had not shopped at Walmart before.

Walmart also simplified the return process for shoppers using its smartphone app, to reduce the average time it takes to process a return from about 5 minutes to 30 seconds.

In addition, private label – Jet.com’s Uniquely J line of CPG products – helps Walmart control supply chain costs, agility and efficiency. Private label also helps Walmart adapt to consumer trends faster. About 60% of the Uniquely J products have organic certification, which consumers say matters more than price and quality.

E-commerce investments pay off – for both rivals

Walmart’s e-commerce business saw gross merchandise volume – measuring all online sales, including Jet.com’s – soar 54% Q3 2017. This result suggests Walmart is eroding Amazon’s dominance. Total revenue climbed 4% to $123 billion and grocery accounts for more than half of Walmart’s U.S. revenue. Due in large part to Walmart’s e-commerce strategy, its shares have gained nearly 23% in the last six months compared to almost 19% for Amazon.

Currently, Amazon is top retailer for online food & beverage sales (18% of market share); Walmart is 2nd at 9%. Amazon’s strengths include logistics, data mastery and top-of-mind brand status for e-commerce.

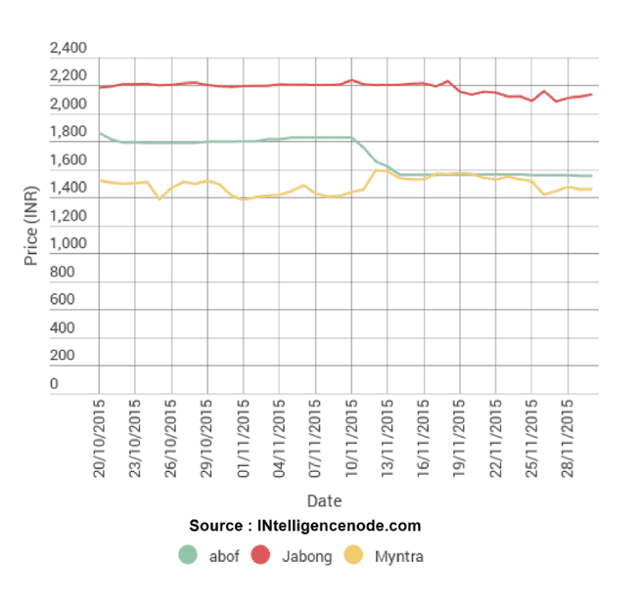

Amazon differentiates its offerings with data-driven marketing. AI software monitoring keeps the retailer on top of competitors’ prices. It also adjusts Amazon’s prices with real-time dynamic pricing to win with consumers. Acquiring Whole Foods gave Amazon hundreds of physical stores and popular 365 private brand products to give online shoppers omnichannel service and variety.

E-grocery opportunities and challenges

Consumers win with online grocery shopping by gaining the convenience and ease of fast, and often free, delivery. They save time, money and effort. (Why wait in a checkout line when you can just answer your doorbell?)

To delight online shoppers, Walmart, Amazon and other grocers must contend with shipping concerns. For instance, groceries reflect three distinct food temperatures:

- Room temperature for shelf-stable centre store products like granola bars

- Refrigerated products like salads, meat and milk

- Frozen foods like ice cream and frozen chicken nuggets

These conditions pose a business challenge, as about a quarter of shoppers who use grocery delivery say frozen food items do not meet their quality standards. Maintaining freshness and proper temperatures across the supply chain to the consumer’s home pose a problem.

Timing also matters. Let’s say a consumer lives in a condominium and isn’t home to receive a delivery. Their building likely does not have refrigerated and frozen areas in the lobby to keep foods fresh until they come home. That’s why Walmart has an advantage with its BOPIS service in physical stores to protect groceries’ freshness.

Looking ahead, Walmart’s priorities include investing in data for competitive pricing and assortment insights, and personalized marketing. Logistics investments can also help Walmart conquer Amazon by delivering groceries to consumers’ doorstep.

This rapid retail evolution suggests online grocery shopping is poised to skyrocket soon. Walmart’s omnichannel strategy acquires essential competencies to attract younger, tech-savvy shoppers. Most importantly, Walmart wisely uses its competitive advantage with brick-and-mortar stores. The retailer gives online grocery shoppers omnichannel delivery options for the superior customer experience they crave.